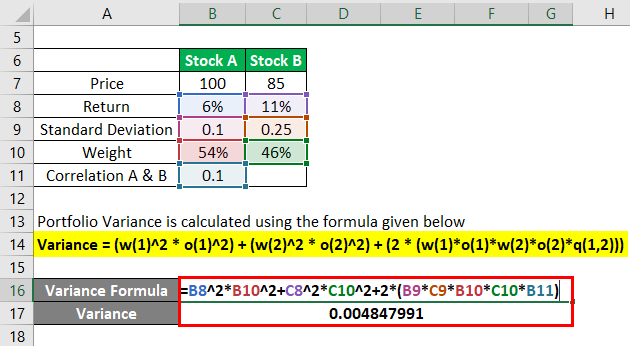

GitHub - SupaMafia/Simple-Portfolio-Calculator: Portfolio Optimization is an important part of investment no matter what you are investing. It is a feature that many trading apps and platform offer, but at what cost.

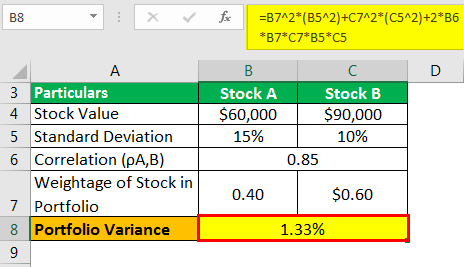

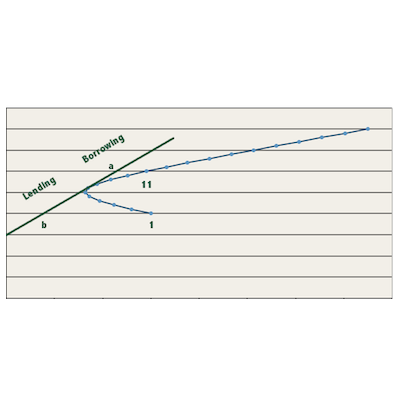

Is this methodology for finding the minimum variance portfolio with no short-selling sound? - Quantitative Finance Stack Exchange

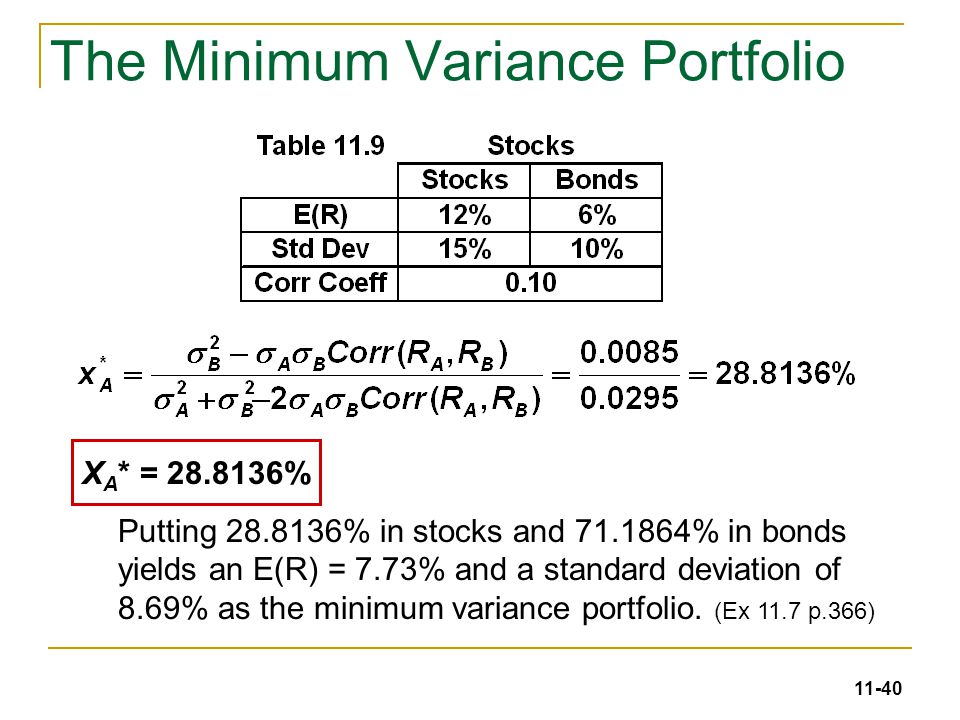

![Minimum Variance Portfolio - [ Definition, Example, Formula Calculation ] - Minimum Variance Portfolio - [ Definition, Example, Formula Calculation ] -](https://www.stockmaster.com/wp-content/uploads/2020/02/minimum-variance-portfolio.jpg)